Renters Insurance in and around Omaha

Looking for renters insurance in Omaha?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

You have plenty of options when it comes to choosing a renters insurance provider in Omaha. Sorting through providers and savings options to pick the right one is a lot to deal with. But if you want reasonably priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy remarkable value and straightforward service by working with State Farm Agent Tom Rivera. That’s because Tom Rivera can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including mementos, musical instruments, swing sets, cameras, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Tom Rivera can be there to help whenever mishaps occur, to get your homelife back to normal. State Farm provides you with insurance protection and is here to help!

Looking for renters insurance in Omaha?

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

Renters insurance may seem like the least of your concerns, and you're wondering if you really need it. But imagine what it would cost to replace all the belongings in your rented condo. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your belongings.

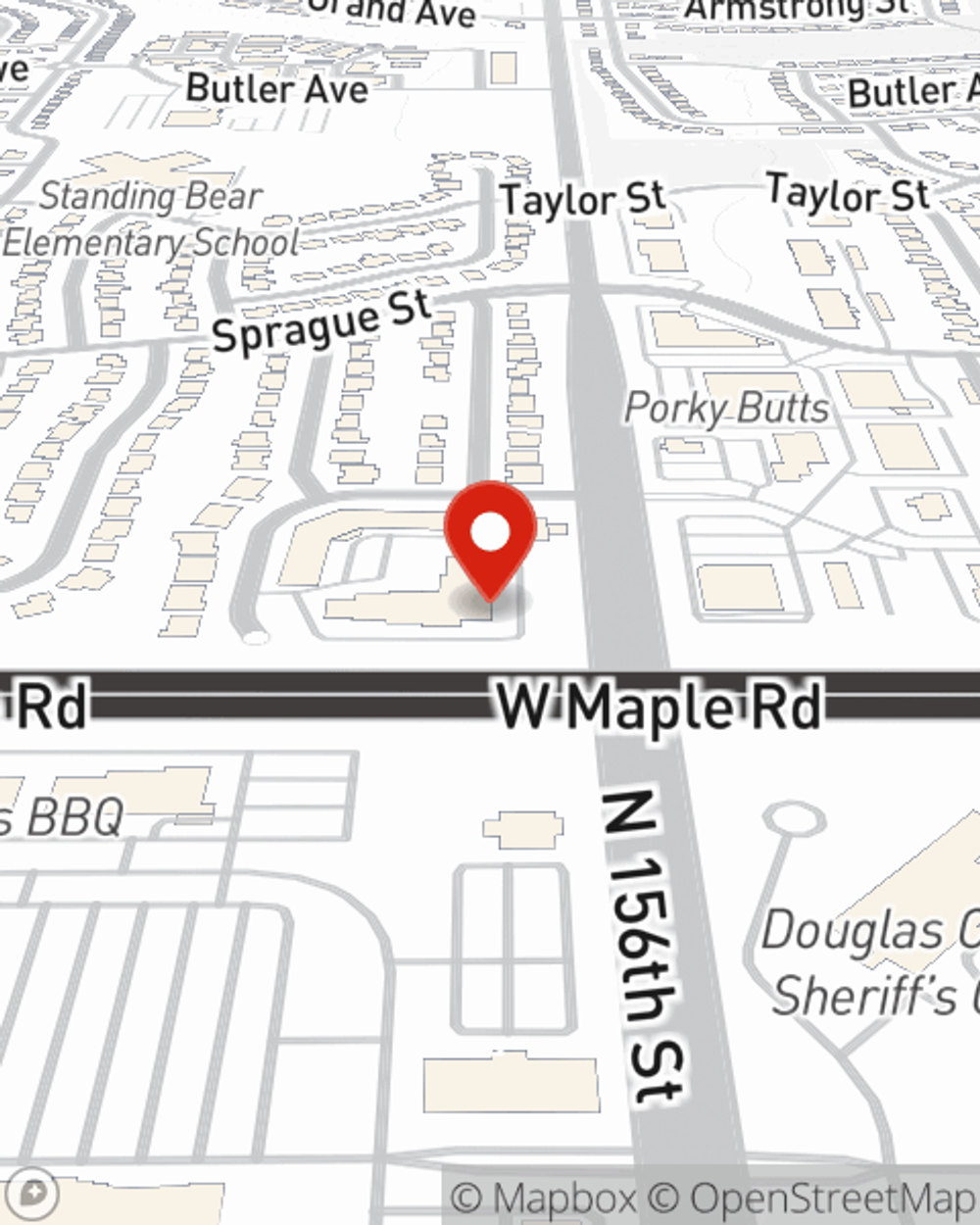

State Farm is a dependable provider of renters insurance in your neighborhood, Omaha. Visit agent Tom Rivera today for a free quote on a renters policy!

Have More Questions About Renters Insurance?

Call Tom at (402) 965-8880 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.