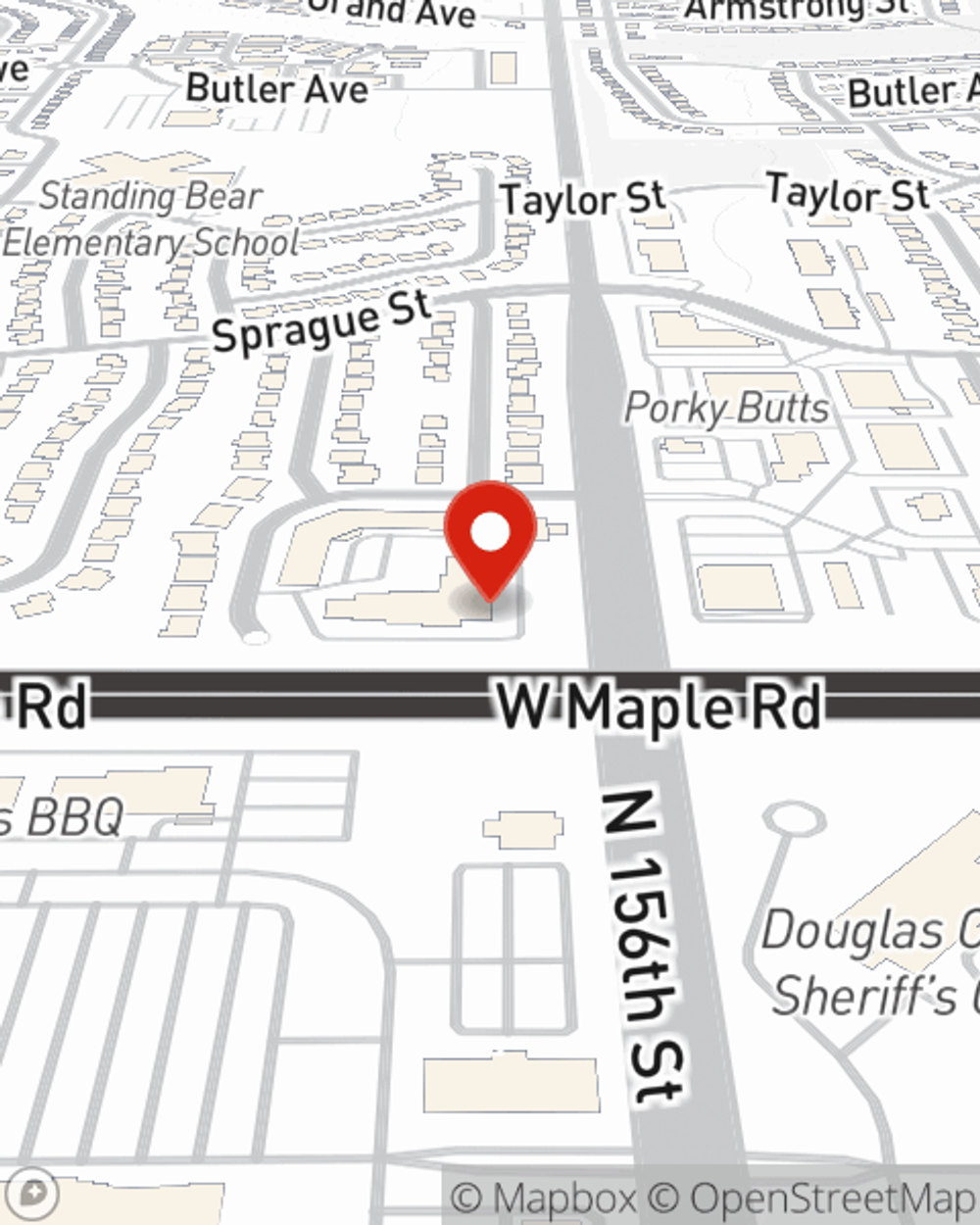

Business Insurance in and around Omaha

One of Omaha’s top choices for small business insurance.

Cover all the bases for your small business

Cost Effective Insurance For Your Business.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Tom Rivera. Tom Rivera understands where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

One of Omaha’s top choices for small business insurance.

Cover all the bases for your small business

Cover Your Business Assets

Whether you are a locksmith a fence contractor, or you own a pet store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Tom Rivera can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and buildings you own.

It's time to get in touch with State Farm agent Tom Rivera. You'll quickly notice why State Farm is one of the leaders in small business insurance.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Tom Rivera

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.